Life Insurance

Ensuring the digital age streamlining coverage for the modern world

Insurise®, our complete Core System and Digital Omnichannel Insurance Platform helps insurance companies become more agile and move away from costly and slow customer relationship strategies.

Our platform allows the realization of all the course of subscription and amendment of the insurance policies for all the desired branches in an insurance company.

Overcome the challenges of digital insurance

Meet the expectations of your policyholders on any channel continuously.

Accelerate the delivery of your digital insurance and reduce its time-to-market.

Minimize physical dependence on agencies.

Optimize costs with automation.

Acquire new customers and increase the engagement of existing customers.

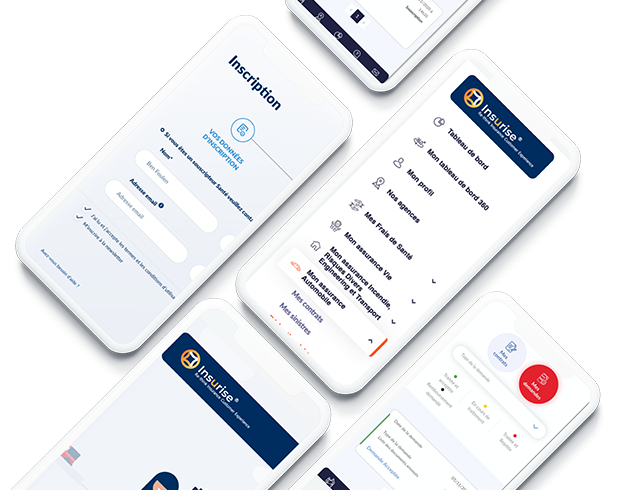

Digital Customer Onboarding

Effortlessly onboard your customers in just a few clicks

With Proxym, you will be able to offer a quick and easy formula to open new accounts, complete KYC, and set up your preferred insurance regulations. Our platform also allows customers to access their insurance information and perform transactions in real-time, providing them with greater transparency and visibility over their insurance expenses.

Digital Claim Management

Tired of all the manual tasks and paperwork coming out of your customers ?

Level up with us

We empower adjusters and agents to automate manual tasks, sift through large data sets and paperwork, and provide a fast and simple customer experience to policyholders.

Simplify your claim processing

By implementing these steps, you will streamline your claim processing, reduce the time and effort required to process claims, and improve the overall experience for the claimants :

- Compile the data about the event.

- Review photos / videos of the sinistrer

- Interview the claimant.

- Talk to witnesses if any.

- Create a case report.

What do we bring to your company ?

With digital channels playing such an important role, not digitizing your insurance processes hampers your company’s ability to thrive in an increasingly fast and competitive market.

We come along to offer you outstanding benefits that will give you and your customer a user journey beyond the realm of convention.

Better customer experience

We grant you with a technology that includes self-service portals and chatbots enabling you to submit claims yourself and check your status anytime.

Faster claims

processing

By automating the claims process, you will reduce the wait times and process claims faster. Manual claims management often comes with friction and delays.

More accurate claims reporting

Claims technology frees up adjusters from handling operational tasks, allowing them to focus on achieving more accurate claims.

Reduced

fraud

Insurance fraud is a problem adjusters face regularly. Without it, claims processing would be much easier to handle.

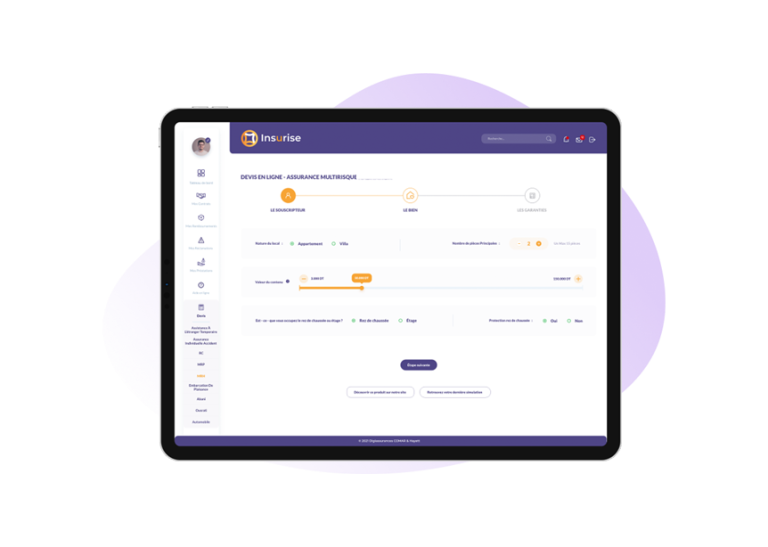

Product Subscription

Be the one to offer Insurance wellness to your customers

Online subscription is a convenient and easeful way for you customers to benefit from our various panoply of features.

You will therefore benefit from a KYC verification & E-Signature, a quotes simulation, the conversion of your quote to a contract, the configuration of your contract’s parameters as well as the payment of your recurring fees.

KYC Verification and E-Signature

Our digital engagement platform will give you and your clients the possibility to free yourself from any tedious and handful work.

What will you gain ?

- Improved customer experience

- Compliance with regulations

- Better customer data management

- Increased security

- Cost savings

What will your customer gain ?

Convenience

Security

Peace of mind

Time-saving

Easy Access

Quotes Simulation

Throughout the customer’s data, we offer you and your customer a way to calculate the potential cost of coverage thanks to our complex and smart algorithms. The output of the simulation is a quote, which is the estimated premium your customer will have to pay for the coverage.

Simulator equipment

Convert your Quote into a Contract

We offer you to streamline and automate your traditional manual methods by using the tools of our engagement platform, giving your clients the ability to digitally convert a quote to a contract and thus create and sign a legally binding agreement.

By using our digital tools, the quote-to-contract process can be completed faster, more accurately, and with a complete audit trail of the agreement. The digital contract can be stored securely and accessed easily for reference and legal enforcement.

Configure your contract parameters and pay your installments Online

Create, store and manage your insurance contracts using our digital tools. This will bring you more transparency, efficiency and convenience in the management of your daily life finances.

Service Request

Our Service request section contains an FAQ heading, a Help heading as well as a examples of useful documents and video tutorials on how your client can use the platform.

FAQ (Frequently asked questions)

We Provide quick and organized information to answer common questions and address common concerns of customers, users, or stakeholders. It saves time for both the inquirer and the responder by reducing the need for repetitive or manual support.

Video

Tutorials

We provide step-by-step guidance and hands-on learning experience for users to understand a new concept, technology, or product. They help users acquire new skills and knowledge in a structured and effective manner.

Useful

Documents

We provide you with what useful documents you may need during the process.